Rachael Maniord

Product Management & Design Leader

The problem

Millennials and young families have a different relationship with money than generations before them. They face a new range of financial pressures from higher house prices to growing education costs.

Young people struggle with pay-cycle to pay-cycle cash flow and need to be diligent in managing their money as well as understanding their future financial needs. They have lifestyle expenses (rent, groceries, bills, transport), but sometimes they also want to enjoy themselves and buy stuff that they can’t afford… This is where deferring payments can help.

Comparing other in-market solutions

Adoption of Buy Now Pay Later (BNPL) has been swift and on mass but largely limited to retail spending and not available for broader lifestyle costs.

The BNPL business model has also come up short for BNPL companies as the lack of understanding of their customers’ financial situation has lead to excessive consumer defaults. In Fact in a survey we conducted with Future u’s user base found that 16% of our users had either become overdrawn, had delayed bill payments or borrowed additional money because of a BNPL arrangement .

Testing our theory about short term credit for everyday expenses, not just retail.

Future u research survey

551 sample size > Male + Female > 18 - 30 years > Australia wide > Currently employed

Fu’s Responsible BNPL solution

Fu helps our members to manage pay-cycle to pay-cycle cash flow challenges, proving some flexibility by “spotting” a small amount of money to pay the rent, buy some groceries or pay a bill. Members simply pay Fu back over a number of flexible payment instalments over 8 weeks. By providing smaller amounts of credit, shorter repayment timelines and an inability to use the platform following failure to repay ensures that the responsible spending issue and customer defaults (that has challenged the BNPL industry) is thoroughly addressed. The amount a user is eligible to borrow is dependant on their financial position and ranges from $50-$500.

How it works

Members are provided with real time affordability assessments based on their underlying transactional data. If eligible, members may then access a small amount of credit - cash funding, paying a bill through BPAY or using a virtual card to tap and pay anywhere.

Repayments are automatically scheduled based on a members’ forecast cash flow. The app automatically identifies when and how much a member can afford to repay over the next 8 weeks. Members can also customise their repayments around their cash flow events.

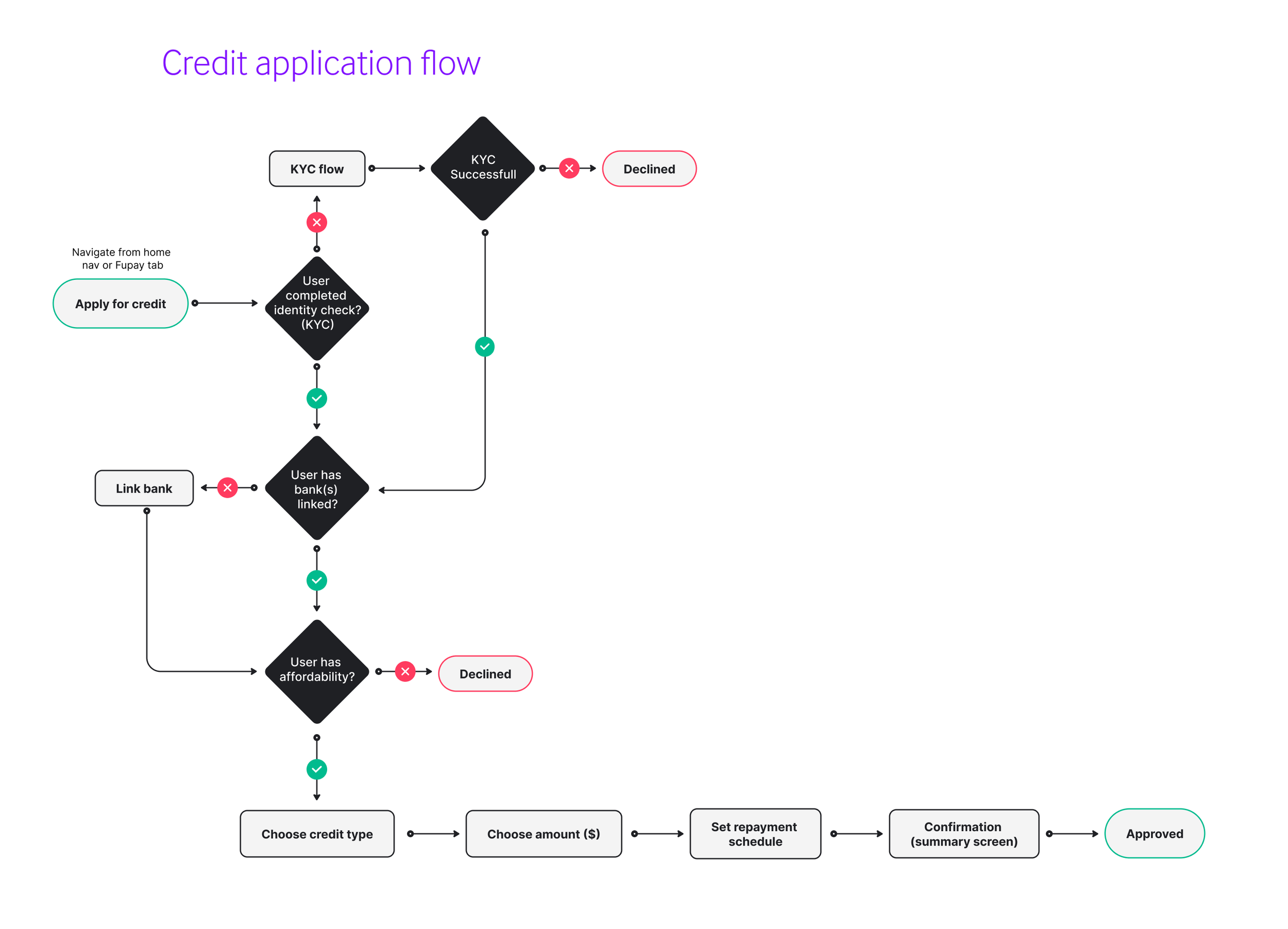

sign up

To access Future u’s credit feature ‘Fupay’ users need to link their bank accounts, complete a Know Your Customer (KYC) check, accept a Direct Debit Agreement for repayments & of course meet Fu’s lending criteria.

Affordability

Fu programmatically determines affordability by assessing the last 3 months of a users transactional data to determine a user’s serviceability to facilitate repayments. Affordability is assessed daily, and can change based on the user’s transactions.

This takes into account Income, regular bills and a users average spending habits.

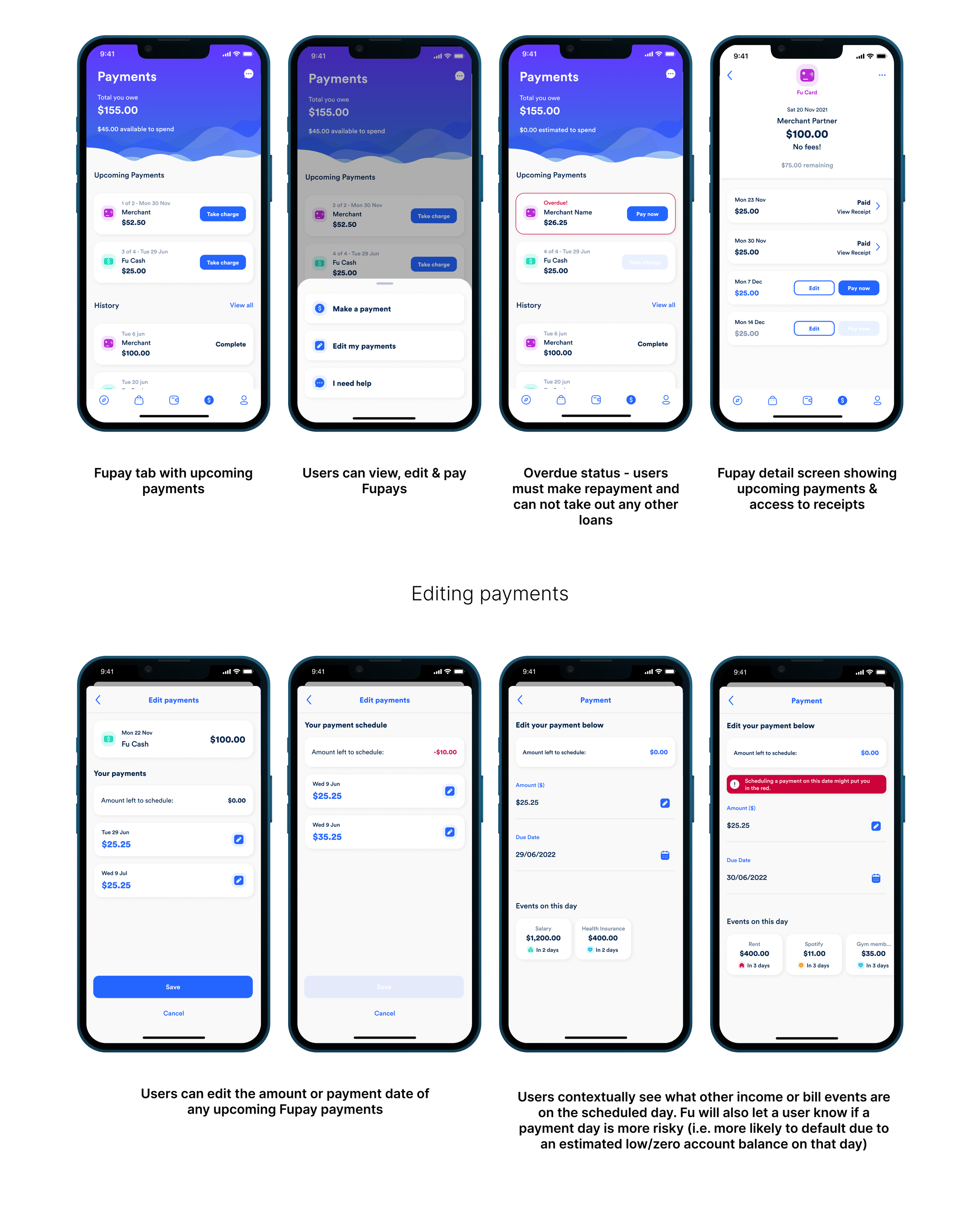

Getting a Fupay

Fu offers the flexibility to defer payments for bills, groceries, rent, cash… you name it. Fu will ‘spot’ the money to pay for lifestyle costs when needed, customers simply need to repay within 8 weeks.

Repayment schedules are automatically centralised around a user’s income day and frequency. Users have the ability to modify their repayments and understand the impacts of doing so. Users can also choose to pay in less repayments or pay a portion upfront and be rewarded with lower fees for doing so.

Fu Bills

Defer all or part of a bill, repay over 8 weeks.

Fu Cash

Receive a cash deposit (max. $200), repay over 8 weeks.