Rachael Maniord

Product Management & Design Leader

Product Summary

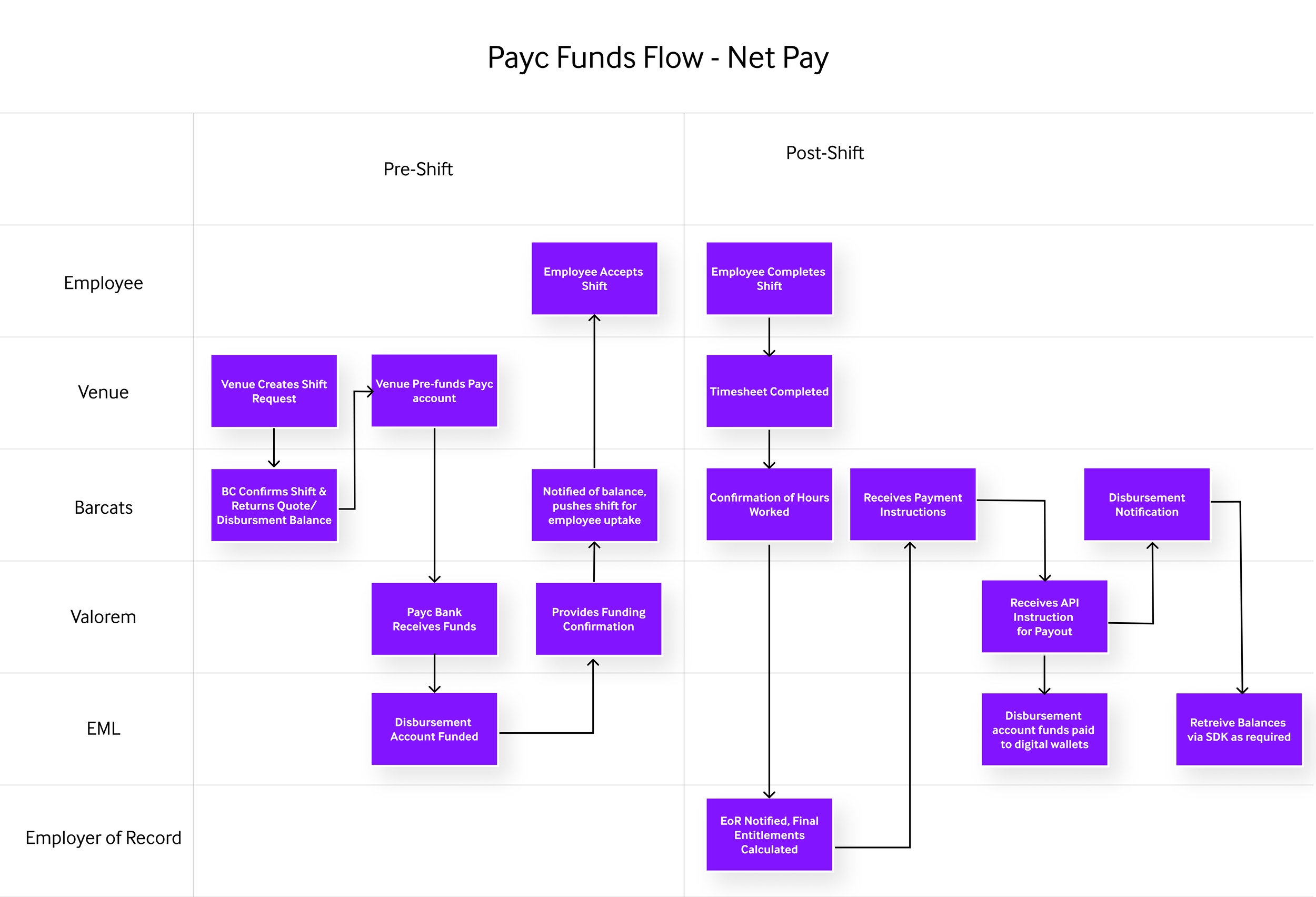

Payc is an exciting new solution for hospitality venues looking for casual employees. A joint venture between Valorem Networks and Barcats, Payc delivers an innovative and customer-first solution for both hospitality venues and employees. The Payc product offering is a combination of a workforce marketplace (to search for and employ casual staff) and a digital Mastercard (for employers to pay employees).

Workforce Marketplace (Barcats): Payc meets the needs of employees and venues alike who are searching for flexible workforce options. For example, an employer can post a shift via the Payc marketplace that they need to cover on short notice with a requirement for an RSA. An employee in the Payc app can accept and work this shift.

Digital Mastercard & Payment Orchestration (Valorem ): Once a shift has been completed, the total payment for the hours worked is paid directly onto the Payc Card which has been issued to the employee via the Payc App.

My Role

Lead PM for Valorem focusing on the Mastercard* portion of the product. This included:

Product managing Valorem’s platform development which handles all payments orchestration of funds.

Working with/consulting Barcats PMs to integrate the Payc App with the Mastercard Issuer - EML Payments (The financial institution that issues the card to the cardholder).

Working with Barcats to ensure that both the marketplace and payments solutions development & release timelines were aligned.

Managing the product and approval processes for the card program across all parties - Valorem, Barcats, EML, Apple Pay, Google Pay and Mastercard.

Lead UX/UI for card related screens: Having worked on design for other card programs (Future u and OnTheMonee) I also provided the UX/UI for card related screens in Payc as well as the Card artwork.

The Workforce marketplace and Payc branding were managed and implemented by Barcats teams.

*A Mastercard is referred to as a card program by financial issuers

Payc JV roadmap

Valorem Platform

The Payc App & Marketplace integrate into the valorem platform to move funds and create Payc Cards

Components of the build for Payc:

Authentication:

Authentication Setup for External Integrators in Platform API

Floats:

We needed to ensure seamless transfers of float balances and automatic replenishment for Payc systems. This project also leverages EML to Monoova for bank transfers and aims to maintain sufficient float balances to handle member withdrawals or disbursements efficiently (in Monoova). The system monitors the Monoova float balance and triggers internal transfers and notifications as needed.

Float Balance Monitoring

Auto Replenishment via EML

Email Notifications

Webhook for “Unlocking” Ongoing Transfers

Internal Tracking

Audit Trail

Cards:

The Valorem API facilitates the creation & management of Payc Cards

Create a member in EML - Create cards (EML account)

Member updates - Pushed to EML

Integration with Manoova to facilitate Card to Bank transfers.

Payc members can receive, spend and transfer funds on their cards

Funding Requirements

A critical part of the Payc product is ensuring that:

Our partners can provide us with float funding for Venues

When funding is provided, Valorem can accurately identify where the deposit needs to be allocated towards and ensure that venue balances are accurately reflected.

Payc has the potential to work with a differing array of organisation venue and card holder setups, this can include cardholders who receive funds from a single venue or multi venues across one or many of our partners.

Due to our "one to many" capability, we need to ensure that we had a tight process to manage funds between our entities so that money can flow freely and accurately between organisations, venues and cardholders.

Valorem Partners

Organisational disbursement account for our B2B programs - e.g. Payc

Location

Subfloats for Employers. Consolidated funds for paying the Employee net salary, statutory benefits, Payc revenue, EoR revenue.

Suspense

Funds that cannot be matched to a location. Awaiting manual intervention.

Fees

Float for revenue.

Pending bank transfers

Money to be moved from EML into Employee bank accounts.

Employee entitlements

Funds awaiting to be sent to employer of record (EoR) who will pay the statutory benefits to relevant parties (ATO, Superannuation, etc)

Cardholders

Member card floats

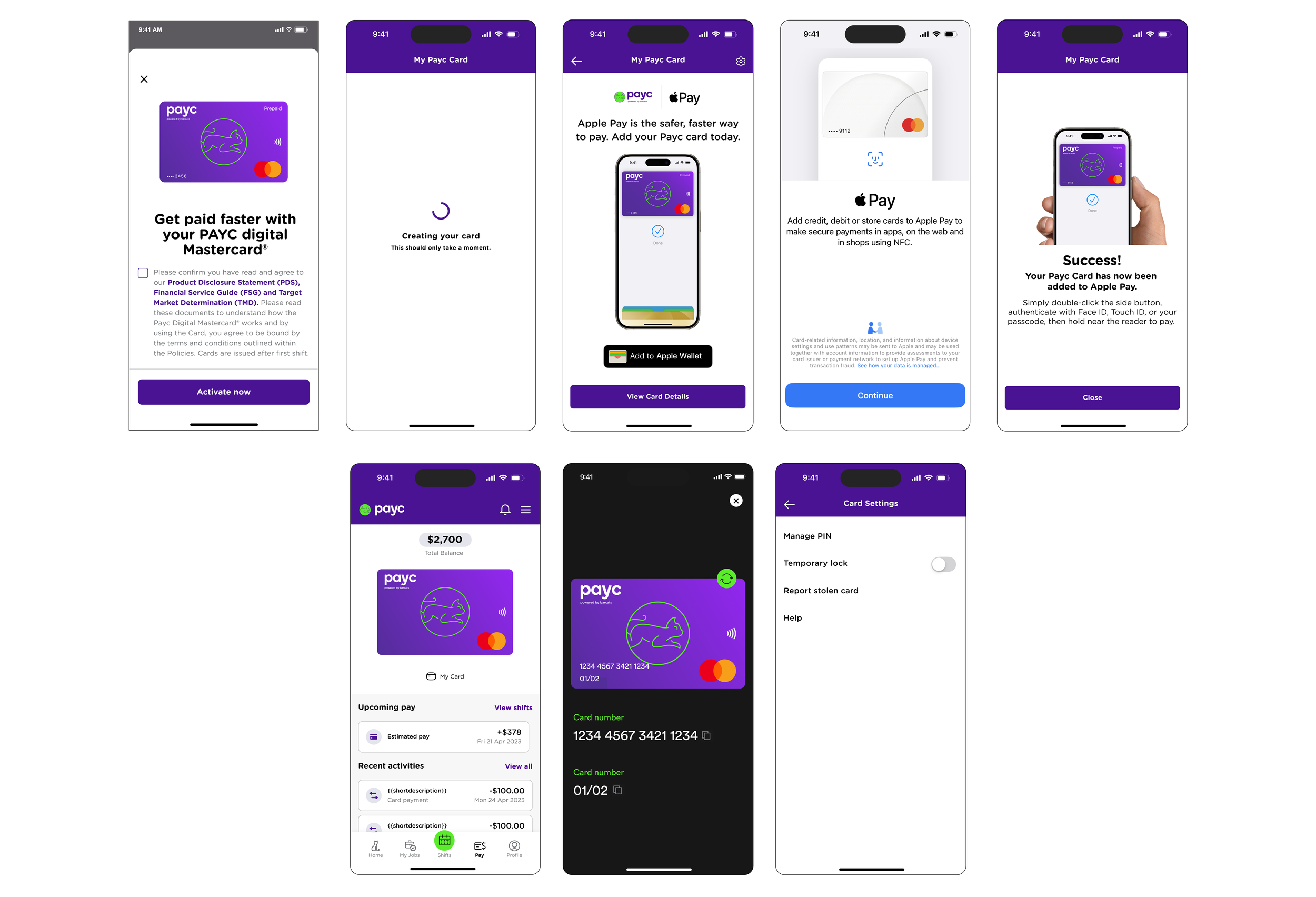

Launching the Payc Card

There are many simultaneous moving parts for creating a card program. This is a minimum 6month endeavour involving working with development teams, the card issuer (EML), Mastercard, Apple Pay and Google Pay. Below is a summary of the process:

Signed Commercial Agreement between the Company and the Card Issuer (EML) - This was reviewed by me and ensured it was signed by Payc’s Directors and submitted back to EML.

Writing up a Program Specification: This is the solution scope document for the program that outlines how it works, card velocities and technical details for funds flows etc. This was written alongside the card issuer and approved by key stakeholders of Payc and EML.

Card Artwork: Creation and approval of the card artwork. Mastercard approval process is 4-6 weeks.

Scheme Approvals: This is Mastercard’s approval of the card program. An “overview” concept deck with wireframes and user-flows is submitted. Approval of the program from Mastercard is required before any development can be undertaken.

AFSL/KYC Process: Compliance forms to complete around Payc’s policies on KYB, KYC and directorships in the business.

Marketing Materials - Apple Pay: Apple Pay has stringent requirements for card artwork and marketing creative. These are executed and supplied to Apple for approval.

Exit Criteria & Launch approval: There’s 2 key parts to completing exit criteria:

Compliance documents: The documents need to be approved by the card issuer, and live at launch of the product. This includes a Privacy policy and Terms, a TMD (Target Market Determination), PDS (Product Disclosure Statement) and FSG (Financial Services Guide), along with Apple Pay Marketing.

Exit testing and approvals: There are two parts to exit testing. The first is successfully passing all criteria for the card issuer. This included testing funds movement within the Valorem Platform as well as things like successfully tokenising 25 cards, making transactions etc. The second is self certification testing requirements to be completed and sent/signed off by Apple and Google. These include screen recording the app and making transactions with the card in a live environment.

Deployment: Apple only releases apps with Apple Pay functionality on the 1st or 3rd Tuesday of each month so that’s a critical path date for release. Google has no requirements once approved, but the Google app cannot be marketed for 30 days as per Apple’s requirement.

Release planning

Apple only releases apps with Apple Pay functionality on the 1st or 3rd Tuesday of each month so that’s a critical path date. This leaves very tight timelines, especially around obtaining external approvals to hit a specific release date. With partners coming onboard early July, Payc planned to release in June. Ensuring all teams in the JV were across the release timeline of all moving parts was essential. If the Apple approval dates are missed, the product with card functionality cannot release until the next available timeslot.

Payc Card UX

The Payc App leverages the Valorem API & EML’s card SDK allows users to:

Create/Tokenise Card

Add to digital wallet

Manage card

Receive & Spend funds

There are also several screens/designs that are required from Apple for iOS users. These flows were supplied to the Barcats developement team. I worked with the Barcats PM’s for requirements and build.

Launch

The Payc Card Program successfully launched in June 2024 along with Payc’s employer/employee products, making its first payments to employees in July. The Payc JV continues to onboard new partners and grow the business.